Attention all you millionaires and billionaires out there because here it comes!

New legislation will be introduced soon and sent up for Congressional approval. Democrats will not only propose to hike the U.S. corporate tax rate from 21% to 28% but in a far-reaching attempt to grab assets from its wealthiest citizens, the Joe Biden White House has included in this plan a mandatory 20% “Wealth Tax” on “unrealized” capital gains. This is unprecedented! Never, ever in the history of the U.S. stock market, not even during the roaring twenties and the subsequent Great Depression had any U.S. lawmaker ever proposed to tax an individual on gains “unrealized”, in other words gains merely on paper.

It is obvious that the Socialists in power want to punish the wealthiest individuals in this country by taxing gains on things not yet received. This is how they propose to balance their blown-up irresponsible “budget”? There’s only one problem with their plan to grab assets, and again it’s obvious that Democrats have very small brain capacities. This legislation, if passed by Congress, would not only crash the U.S. stock market, it would destroy it permanently – the patient will be dead on arrival, with no chance of resuscitation. After all, who in their right mind would want to hold U.S. stocks when you’re subject to being taxed on gains “at risk”, in other words, gains you haven’t even realized, or locked in yet? The idea is ludicrous – really beyond ridiculous! Just where do Democrats come up with their insanities? How do they function each day in their make-believe worlds?

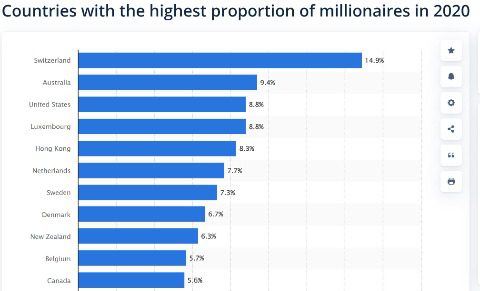

As of this writing, there are around 23 million U.S. households with $1 million or more in net worth, or around 9% of the U.S. population. Understand that these same wealthy households are holding probably 70-80% of the stock market’s value in the country today. You want to upset that apple cart? I don’t think so, only a person void of sanity would go forth with such a plan as this one proposed by these Socialists. FYI, the United States ranks third in the world for the number of millionaires behind both Switzerland and Australia.

What will happen when the federal government attempts to effectively “embezzle” funds from any astute investor? Investors will move their assets out of the country that’s what will happen! Not only will they sell their U.S. holdings they will move their wealth outside of the United States entirely! Then where are we as a nation? A country? A concern? You think this country can afford to lose the tax revenue it’s already collecting from its wealthiest citizens?… these Socialists continue to out-do themselves with absolutely insane proposals!

Why invest in a startup biotech that cures cancer? Why invest your risk capital in anything? Rockets, solar technologies or electric cars? Why invest in AI, better 5G or anything revolutionary. Risk/reward says don’t do it. So, it won’t be done! Redistribution of wealth usually comes back to bite average citizens. They’ve already brought dual income down to 400k in the same bill. Dumb asses!

Yep, why would anyone risk their capital under those circumstances? Makes zero sense. Example: You purchase stock for $20/share, it goes to $35/share by year end but the position is still long. You receive a tax bill on unrealized gains to the effect of $15/share, a 60% capital gain. The following year the CEO is caught boinking his secretary. Stock opens the following day @ zero, and the company declares bankruptcy. Your actual realized gain is a 100% loss. However, your unrealized gain for a moment in time was 60% for which you were assessed and paid capital gain taxes the previous year. Is the IRS going to refund that tax you paid on unrealized gains before the company went under? Laughable! No, if this were to ever pass I’m immediately out of the U.S. stock market!