I AM REPOSTING THIS WRITING FROM MY BLOG BACK IN FEBRUARY OF THIS YEAR –

I am updating my prediction for the NASDAQ Composite Index. It appears to me now that the NASDAQ bottom in this downturn could easily see the index fall to the 9,600 to 9,800 level. My question to all those Leftist Tech Oligarchs who continuously censor free speech, and accurate reporting of the Truth, are these Socialists having fun yet? The fun has just begun for all you Socialist Wokes… LMAO!

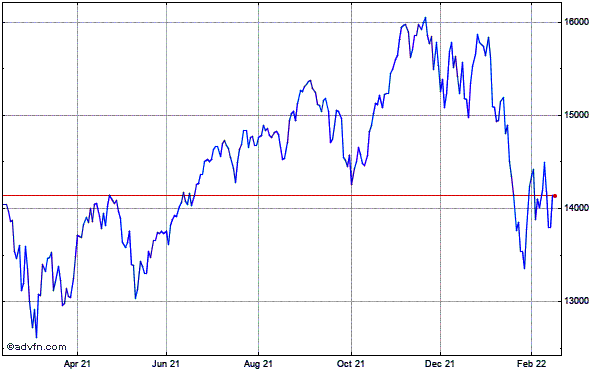

C’mon Man! You loved me @ 16,212 didn’t you?

Then why can’t you love me @ 11,300? Asks the NASDAQ Composite Index.

Carol King released a hit song back in the day, “Will You Still Love Me Tomorrow?” Gee, nothing like investors loving ’em and leavin’ ’em right? You see the NASDAQ, which bet the farm on technology stocks, is a little under the weather these days. But there’s still plenty non-believers, or hanger-oners out there, those people who don’t believe the inevitable is inevitable? 🙂

The NASDAQ Composite had a historic run. Twenty years ago this month the value on the index closed around 1,805. Thus far the all-time high for the index occurred this past November @ 16,212. That’s a return of around 900%, or 9 times your money over a 20-year timeframe, making tech oligarchs the envy of Wall St. What could possibly go wrong right? Right! I mean wrong!… or something like that.

All things are not copacetic these days in techy-techy land. There’s a few issues to deal with and it couldn’t have come at a worse time for these oligarchs with H.S. educations. Pressure from lawmakers in Washington, D.C. to regulate and limit the amount of personal privacy invasion of our citizens along with protections against violating the free speech rights of ordinary Americans, which have been lost on several of these social media platforms are now pending lawsuits. All this has drawn the attention of both major political parties, but mostly the Republicans. The lying cup runneth-over between social media companies and the mainstream media networks in this country, all at a time when it seemed that things couldn’t get any better for progressive left-minded persons. However, nothing remains the same, and now they face considerable push back on their efforts to silence us (to silence the truth) and their use of social media to promote Socialists into every office imaginable, along with collaborating efforts with several fake news media outlets. Add all that up and it’s a total mess orchestrated by some really bad folks…

All seemed manageable enough for Tech stocks to hang around in all-time highs until the new kid in town arrived, and he’s about to get started. The new kid in town is what’s required to reduce incipient inflationary pressures, that is much higher U.S. interest rates. Oh yes, the deathnel to growthy tech stocks is coming to town and the Federal Reserve will have no choice but to begin raising interest rates and what makes this tightening different? This time around our Federal Reserve is way, way behind the curve. For example, if consumer inflation is running around 7% year over year (and that doesn’t even include food and energy), what do you think U.S. inflation is really running, certainly North of 10% annually? These are mind-numbing inflationary pressures. And high interest rate environments crush growth stocks, almost all of these techy outfits fall into the same category known as growth plays, or long-term growth companies.

Growth stocks have way outperformed Value stocks at a time when interest rates were essentially set to zero. The Federal Reserve hasn’t hiked short-term interest rates in a while, still today short-term rates remain @ virtually zero. So do the math, with inflation running 7% and interest rates currently @ 0%, that means we already have negative interest rates in this country, -7%. So just out of the gate before the Fed announces the first rate hike we’re already losing 7% of our purchasing power. Now how many rate hikes of 1/4 point, or even 1/2 point rate hikes would be required to bring interest rates in the United States up to meet current measures of inflation? In other words, to neutralize inflationary pressures? The answer is one-Hell-of-a-lot, that’s for certain. Ouch!

Gee, and just when Apple announced it would stop supplying Facebook with personal information on its users for the purpose of targeting ads at the end of 2021 citing “ethical concerns”? I guess Tech Oligarch-ing is a tough gig, and it appears to be getting tougher by the day. My prediction, and I have stated this a couple times on my website already, my prediction is that we haven’t seen much in the way of a conviction towards lightening up on technology stocks, not yet. My belief is that the NASDAQ Composite Index will eventually fall to around a 11,300 handle or so before this [required] corrective phase in “all things tech” is complete. That’s around 20% below where the index sits at this writing…

Bon Voyage! 😉

https://stockcharts.com/freecharts/rrg/?s=xlb,xlc,xle,xlf,xli,xlk,xlp,xlre,xlu,xlv,xly&b=spy

No safe haven:

We could break them down but, it’s irrelevant at this point. The strength in the dollar has even hit the commodity complex but, I expect this to be short lived and bought USO, keeping it on a short leash. Using standard pivots, we’ve blown our first level of support (S1) on the Nasdaq. From there S2 is sitting at 10,843 and if we close below that support will be going to 9,403, 8705. That would be capitulation. We may need to remind people of the clear differences between taxable and tax deffered accounts. It’s much more difficult to get back to break even in taxable accounts. Example Taxable: You sell to take profits of $200,000, great, you’re safe but Uncle Sam leaves you with just $160,000 to reinvest (ouch)! You’ll need a 25% return to get back to your original $200,000 and in real market returns, that’s a lot of returns needed. That’s when you buy insurance which is very expensive now. Most bear markets last about 13 1/2 months. We’re not at a bottom yet. Remember, cash IS a position. The bond market has sold hard, working it’s best to get what the Fed and Biden have gotten wrong. That’s Government 101. Don’t buy the dip!

Yea I concur, that’s pretty good information. There isn’t a backstop for dip buyers, not that I recognize anyway, not this time. Sure if you had competent people in important positions in the United States government, sure, one could make a good argument for buying the dip because a clear solution could be had in the not too distant future. There isn’t anything but clouds and obscurity ahead. That’s the definition of high risk. That’s the very reason why we’re in this situation, because of incompetence at every level of our federal government, all the way to the White House.

What I find most amusing is that these tech oiligarchs contributed billions to get this clown show elected, and who’s getting the brunt of the selling. I let go of all tech exposure before the end of the year when it was down to maybe only 2-3% of the portfolio via one etf holding. I started dumping tech in late 2019/early 2020!

The bond market, which experienced a 42-year bull market, is still not where I predicted it could go, should go. The 10-year treasury spent decades between a 5-7.5% yield, that’s normal for that maturity term. We’ve been between .69% and 3% for what 2 decades now? Why? Because of Democrat high tax policies and Leftists co-habitating with Communist China and European Socialists, that dual combo destroyed millions of American manufacturing jobs and investment went overseas instead of here at home. This country is a frigging total mess, and corporations hugging woke liberals and placing them on their boards, etc.

All and all I could go on forever with what idiots have done in key corporate and political positions to screw up the American economy. Instead, I would look at it this way – at this writing I see no impetus, no reason whatsoever to go long in either the U.S. bond or stock markets. No reason whatsoever… I hope that changes?

Gaw-awll-lee! 🙂 Well, when you get that much stimulus from the Fed over a period of years, QE’s to infinity, all kinds of bad ideas are going to blossom, that’s where we were thru last year. Now it’s about to be “nut-cutting” time. We’re all getting ready to see how long “conviction” lasts. My prediction is alot of these tech stocks run for the hills in the not to distant future.

We’re still in the “cinderella phase” based on the tape, hanging in there, but I think the U.S. entered a bear market in the final months of 2021. And look we have the perfect recipe for one, we have weak and clueless leadership coming out of Washington. Everything they touch turns to shit, stack that on top of a Fed “squeeze”. Our Federal Reserve was caught with their pants down, and they still refuse to pull them up. How long will refusing to tighten rates go on in this country? We’ll be making down payments to buy bread and milk at this rate pretty soon. 🙂

Gee Wally, we’re screwed. Nah Beav, we’re double screwed. We’ll have to pay for it.

The Beav! I had a beaver once, but she left! 🙂

LMAO! Mrs Cleaver looking pretty hot eh Eddy?

Wait cause when I watch those episodes? June is finally younger than me! 🙂

Golly Beaver, that would be a crisis. That would add to climate change which means weather would happen. I want climate control…

Sub-Techs (no P/E & indebted) aren’t through yet, they’ve merely fallen off a very tall cliff. Watch your JUNK, rates are rising and we will see companies, propped up by free money begin to fail as they attempt to refinance existing debt with not so free money.

Secondary offerings will come, diluting shareholders even further. Free money has merely prolonged the inevitable. The snowball affect has a long mountain slope to gather mass and speed.

However, “making predictions is difficult, especially when predicting the future” – Neil’s Bohr