This commentary of mine was first published 10 months ago in July of 2022 where I warned that the United States is facing a rare major downgrade on its sovereign debt. These events rock financial markets and I would expect it to once again. Do you feel lucky right now? Because there is no where to hide once a downgrade is announced by a major bond rating agency. Rating agency Fitch just released a warning on U.S. Debt, saying they have placed our government debt on “Credit Watch Negative”, which is usually the first step in the process.

This was once a popular song title by the English band, The Fixx. But were we really [ever] “saved by zero”? I’m going to present an argument highly supportive of the thesis that yes, indeed, a ton of Americans, many of us really, benefited by interest rates set @ zero for decades. We benefited in ways one could have never imagined from the start back in the late 1980’s. I’m not going to bore you here with charts showing this or that. Instead, I’m going to talk to you and if you need further proof of my argument then you are welcomed to find [more] charts and graphs on the subject. The funny thing is, in financial matters anyway, many of us had actually come to believe that it was we who somehow morphed into financial geniuses, when in reality we were made good, we were simply “saved by zero”. Now let’s take a look at what could happen going forward, my view is not [yet] the consensus view –

In the 1970’s we had rising inflation, it was a problem in the United States really through all of the 1980’s. Interest rates were exceptionally high compared to today’s standards. Banks paying 10% interest on certificates of deposit to mature in just one year, this was common. Mortgage rates peaked around 21%. Imagine taking out a mortgage on a home and paying an interest rate of 21% per year on the unpaid balance, what a nightmare that would be. I closed on my first home back in 1984, a starter home, my mortgage rate was 12.875%, I thought that was a decent deal? Today, I have a mortgage, my rate is 2.75% and to some people that’s high, LMAO!

There were tons of reasons why over the preceding 40+ years interest rates generally fell in the United States, I have written about this subject on here before [you can type key words into the space bar on my home page to find those]. What I’m proposing now is that the long cycle of low and ever-lower U.S. interest rates may have finally ended. I love to talk about what no one else is considering, like what if interest rates continued their stubborn climb? Considering that we have substantial supply constraints going on in many sectors of the economy and the idea is not off the table. Combine that with policy errors such as hiking tax rates and more unnecessary federal stimulus programs and we’re just about there right? Most pundits on Wall St. have interest rates falling again early next year because of the “economic slowdown”. I’m thinking that idea is a bit pre-mature? See they have to [selfishly] find a way for the stock market to resume its bull run, and future interest rate hikes will clearly stand in the way of that run. So they conveniently forecast for the Fed to lower interest rates beginning next year, and of course with that they can keep their financial strategy jobs and their meaningful forecasts for the resumption of a bull market in stocks. No So FAST Snappy! Sit down, shut up, and listen to this – interest rates could rise for an extended period of time. They could. You may be asking yourself “where’s the evidence for this argument?” Well, consider a few things. First of all, this isn’t your grandfather’s U.S. economy, that went by the wayside a long time ago. Socialism has arrived, it doesn’t matter that it began by electing crazies to Congress, or the White House or appointing a nutcase for Treasury Secretary and implementing “climate change” initiatives even inside the Security and Exchange Commission (SEC). It’s the order of the day, crazies are now in charge of steering every federal agency. With that said, what matters most is Socialism is alive and well in these United States. It has permeated every level of government from the federal to state and now even local school boards. And what does Socialism bring to the table? Lots of very bad things but government regulatory overreach [on steroids] and higher taxes are stand-outs. So what will happen next? U.S. Productivity numbers must fall under this scenario because corporate earnings will be under continuous pressure. Then what? Stocks that could typically trade with P/E ratios (valuations) North of 40 to even 140 times earnings [like an Amazon for example] will be unheard of. Under Socialism you don’t get high multiples anymore on stocks because the U.S. economy will become the “walking wounded”. Sure, there can still be positive Gross Domestic Product, (GDP) numbers if you like annual growth rates in the sub-two percent range. How about annual GDP growth of .50% to 1.5% annually, how does that sound? You think those [current] 11 million U.S. job openings might dry up [in a heartbeat]? 🙂 We last saw these annual GDP growth rates produced by the Obama White House over both terms. However, back then we didn’t have supply issues/constraints [like we have today], and we weren’t running a federal deficit that exceeded more than three quarters of our annual GDP growth back then either. Don’t get me wrong, it is possible to grow out of a big federal deficit, the U.S. has done it before, but never under Socialism!

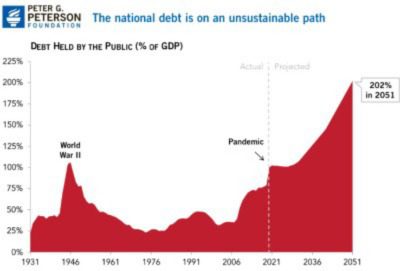

On August 5th 2011 several ratings agencies downgraded U.S. Treasury debt from AAA to AA+, which caused a massive sell-off in the U.S. stock market. [Do you know what our Federal Deficit was back in August of 2011? A mere $1.48 trillion, that’s it! Compare that to a $33 trillion dollar federal deficit today… LMTAO!] And what happens when an issuer’s debt ratings gets lowered? They have to pay higher interest on any new issuance of debt going forward just to get takers, just for the issue to be fully subscribed/placed. In either case, any agency suffering a downgrade is sitting with a lot less borrowing power, as credibility on repayment of debt is lost overnight. U.S. financial markets will react negative immediately, probably even over-react spreading fear across all markets. Now do you see where I’m going? Do you still think I’m crazy? I’m sounding the horn here for what’s coming. Mark my words, if the right people are not elected and appointed immediately – all competent people, in other words, zero Democrats/Socialists/Leftists/Progressives; if not, this is where you will find these United States and its stock and treasury bond markets, in a place known as disaster-land!

In summary, we as Americans have [in a sense] been saved by zero over most of the past four decades. But in reflecting back, we could afford most of it [then] because we were big producers [mostly unconstrained] of those things we needed. Thus, the economic environment was generally sustainable. What happens when we become victims of big government with their regulatory overreach and high tax schemes? Our ability to produce abundantly ends and with that comes a host of new problems. I’m not against the U.S. Treasury running deficits, I’m not one of those zealots that believes only in a continuously balanced budget [which is not optimal anyway], what I am against is running federal deficits with absolutely “zero” ability to pay them back. This condition describes why a disaster awaits U.S. financial markets [under Socialists and the Socialist agendas].

Addendum to My Original Post:

“The Congressional Budget Office (CBO) projects that interest payments will total $663 billion in fiscal year 2023 and rise rapidly throughout the next decade — climbing from $745 billion in 2024 to $1.4 trillion in 2033. In total, net interest payments will total nearly $10.6 trillion over the next decade.” My point is, how are these interest payment obligations going to be met when Socialists who run the government basically place a “governor” on the U.S. economy? The answer is they’re no-going-to-be-met. You can’t grow out of this level of debt running sub-2.0% net growth each year, not going to happen. Expect a debt downgrade, and maybe even multiple downgrades [from the major bond rating agencies] on U.S. debt obligations going forward, along with stubbornly higher rates of interest. If you have money parked inside muni-bonds that were issued in Woke Leftist states such as California, Illinois, Connecticut, Massachusetts, New York, New Jersey, Oregon and Washington State you’re either blind to the truth or you’re crazy, maybe both!

We are in trouble. We won’t see high multiples under this administration and we stomp out socialism. Under socialism you create oligarchs and grant them powers and regulations to their benefit. The key ingredient that goes missing, innovation, the bedrock of unencumbered capitalism. Simpler yet, no new company that would force the oligarchs to compete in creating new and better products. Old companies doing things the same old way.

That leads to higher prices and very low P/E multiples.

Yep, yep, yep. I thought the other day, what if we corralled all these Socialists and forced them to complete an Economics 101 Course, would that alleviate some problems we find ourselves in? Probably would. I was driving in my car and thought maybe I should volunteer to teach this class? Designed initially for the third grade level but that’s where idiots promoting Socialism are, like Day 1 would be to define terms like “Supply” – it’s how many of something is available. Whereas “Demand” is how many of those same things someone wants… what happens when demand doesn’t meet supply? Or supply cannot meet demand? What happens when you over-regulate supply? What happens when you raise taxes on firms and individuals? Quiz on Monday! 🙂

By the time the transition to Socialism is complete, I’m looking for the U.S. stock market [et. al.] to trade at 8 to no more than 10 times earnings. Gone will be all of those high fliers. That’s what happens under a Socialist regime, you don’t get high valuations. LMAO at all the fools that vote these Democrats into office!