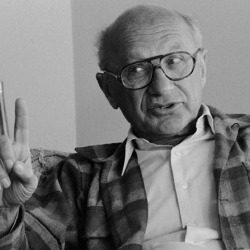

I do believe that 250 years ago when this country began it’s journey as a free nation [above all else] that the Founders probably envisioned little central government influence going forward – nor its interference, into our lives. This idea has been associated with the beliefs of the great economist Milton Friedman – whose ideals of running sustainable economies over time required the implementation of laissez-faire Capitalism. Friedman’s ideal economy would let the forces of supply and demand determine winners and losers with little, or no, intervention by central governments. Given the efficiency of the mechanics of supply and demand operating unencumbered Friedman believed was the only way – the best way, to sustain economic growth over long periods of time.

So what happened here? Why don’t we live in this “Miltonian World”? I cannot claim I have the definitive answer as it’s most likely a combination of a few things that happened along the journey to “Milton Friedmanism”. I will give you my two cents worth here as to why I believe we are, and have been for decades, living more of a “Keynesian Existence” in the United States. [John Maynard Keynes was a British Economist that believed the business cycle, along with free market capitalism, was generally flawed and government intervention into markets was vital, vital!]

How did it come to pass that the Federal Government is so ingrained in our everyday lives? I think the answer lies in looking at it in a “cause and effect” interative way instead of looking for one single answer. One thing led to another in this case because certain actions have reactions:

1) The first thing I’d like to point out is that Americans have been over-taxed for some time – years really, if not for decades now. I’m not going to list all the taxes that we pay on here, the list is exhaustive but let’s just say that in general, personal and corporate taxes have been outrageous, especially prior to this last tax reform act. The taxpayer and the Federal Government have over time formed a symbiotic relationship. So the government now has a vested interest in it’s taxpayers staying healthy and employed so that it can be constantly fed because the government has become a very large customer/consumer in its own right.

The effects of high taxation has been evidenced by a ton of money, plant, equipment, and some innovation leaving the country for greener pastures abroad where corporate taxes were much friendlier than here in the United States… and turns out, there were a ton of other countries to choose from. To see all this repatriated back here though will take some time even if we do elect the right people to office.

2) The second item would be the strength of the U.S. Dollar. There exists no currency in the world that can match the “safe haven” status of the U.S. Dollar. Oil and other commodities are traded in dollars around the world everyday. A “strong currency” status has both good and bad ramifications – when the economies of many a foreign country are struggling, or in the tank, compared to the U.S. economy, dollar strength comes with the territory. The Federal Government generally wants our currency to be strong but not too strong as that would discourage foreigners buying anything “made in America”. Conversely, when the dollar is weak, we import inflation because we are a net purveyor of goods mostly. We don’t export that much today but we would like to in the future, a strong dollar can be a headwind to getting that accomplished anytime soon. In summary, the strength of the dollar has been a factor in discouraging manufacturing operations of all types, along with the obnoxiously high corporate tax rates of the past as I mentioned earlier.

3) The last thing I want to point out as to why government is over-reaching is part of the push toward “Globalization”. We have placed a tremendous burden on ourselves, and all our government entities, by escalating immigration without regard to selecting those that can contribute to our society almost immediately. The Federal government practiced chain migration for years, and now we have the situation where unproductive people are taxing our doctors, clinics, hospitals, and our state and local resources. In addition, our government and it’s taxpayers cannot continue to afford to be the Policeman of the world – it’s Savior. We must allow foreign countries to face their own destiny(ies) on-their-own.

Final Thoughts:

We are in a situation in this country today where I think we are too dependent on this monster we’ve created known as Big Government. It’s like a chain reaction where government needs us to stick around just so we can feel obligated to keep feeding it? There are no Keynesian Utopias… and what is the best way to get a monster to leave? You stop feeding it! Then and only then will anything resembling “Milton Friedman” return and our government’s encroachment into our private lives cease!

Its in reality a huge post. I am sure that anyone would like to visit it again and again. After reading this post I got some very unique information which are in actual fact very helpful for anyone. This is a post experiencing some crucial information. I wish that in future such posting should go on.

For a long time I have maintained the only way to make the central government smaller is give them less money to spend , hire , etc. That would be to greatly lower taxes and fees assessed by HOG that ate our DREAM of free enterprise. I am not sure is possible at this point but it is the one and only way to reclaim our birthright.

Absolutely! Reduce salaries of elected officials all throughout the land. Make serving government a service job that pays little but comes with recognition that can lead to big opportunities afterward. If Congress can vote on our healthcare then they need also be subject to that same healthcare they are voting on, etc.

Thanks for your participation in my new website Gary!