Unwrapping American Capitalism

The take away from this exercise is to understand that government spending, along with increased tax burdens, can eventually crowd out personal consumption and investment, and result in reducing future growth.

The take away from this exercise is to understand that government spending, along with increased tax burdens, can eventually crowd out personal consumption and investment, and result in reducing future growth.

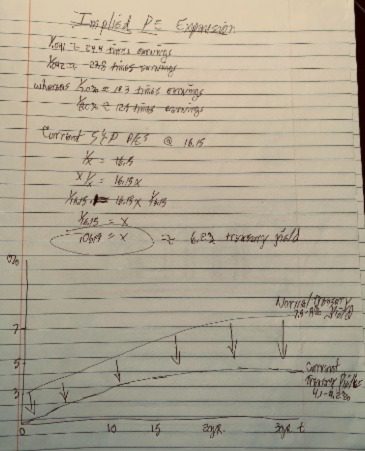

The Implied P/E Expansion Model is a simple quick-test to assist in determining whether current valuations in the U.S. stock market [in aggregate] make sense given the level of interest rates. What’s funny about this is that 15 years ago I wrote that the “normal” 10-year Treasury yield was 7.5-8%!

Take a look under the hood of your portfolio to see if you are “fighting the Fed”? “Never Fight the Fed” is one of the oldest monikers on Wall St.

Let me introduce to you what you can expect next from these Leftist Alarmists, once “Climate Change” has been totally discredited, [and it will be], I predict they’ll turn to the next follow-on lie…

Inflation will continue to roar @ 15% [including food and energy]. The next Fed rate meeting is not until September. Given the highest runaway inflation since the 1970’s, the Fed will need to deliver yet another large hike in rates. How is that compatible with growth stocks?

There’s a ton of misnomers about this subject. Some people have become experts on this subject. I would like to dispel some of the popular rumors out there, especially for all you non-financial types on the subject of Social Security payments.

I’m re-releasing this blog post again, published in early February of this year – it’s required reading! Was Ron Paul

The most surprising thing about Wall St. is the fact that we need both of these types – the forever optimists and forever pessimists. Each of them are just as important as the other.

I was about to undergo a new project where tons of measurements had to be taken and suddenly I realized that there wasn’t a pencil in the house. After scouring around, I found two pencil remnants, very short and only one had any eraser left. So I did something I haven’t done since my kids were in elementary school, I went shopping for pencils.

If we are at the end of this run-up in commodities, and hence inflationary pressures, some factors we haven’t seen before could be responsible, making the end of this economic expansion look much different than those of the past.

Let’s discuss the mysterious Number 9. This number fascinates me since I found out on my own that when adding a numerical sequence with the purpose of reducing it to a single digit the number 9 does some very interesting stuff indeed!

Have you ever heard the term “the lost decade”? It was used to describe a period of time after the internet bubble burst in the year 2000 which preceded a decade long bear market in U.S. stocks. The S&P 500 Index returned a paltry 2.3%/year, a consistently negative net return after inflation, and for an entire decade!