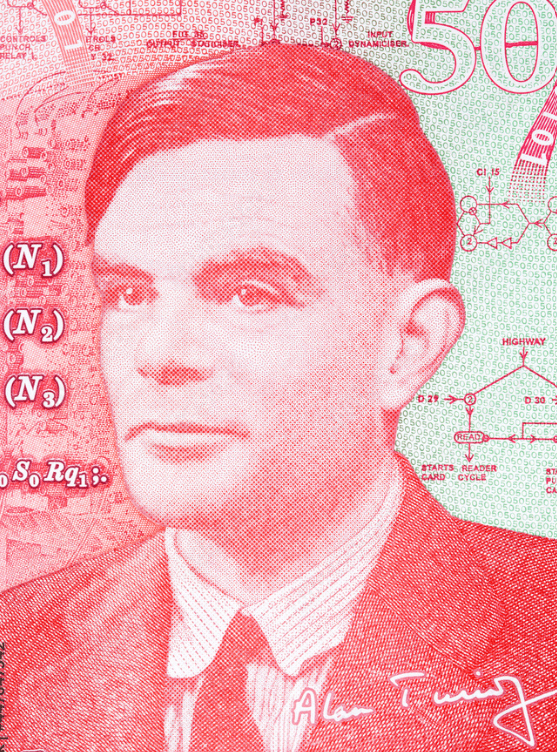

Alan Turing Invented Artificial Intelligence

Tech Oligarchs did not invent Artificial Intelligence despite their claims, this discovery came before they were even born!

Tech Oligarchs did not invent Artificial Intelligence despite their claims, this discovery came before they were even born!

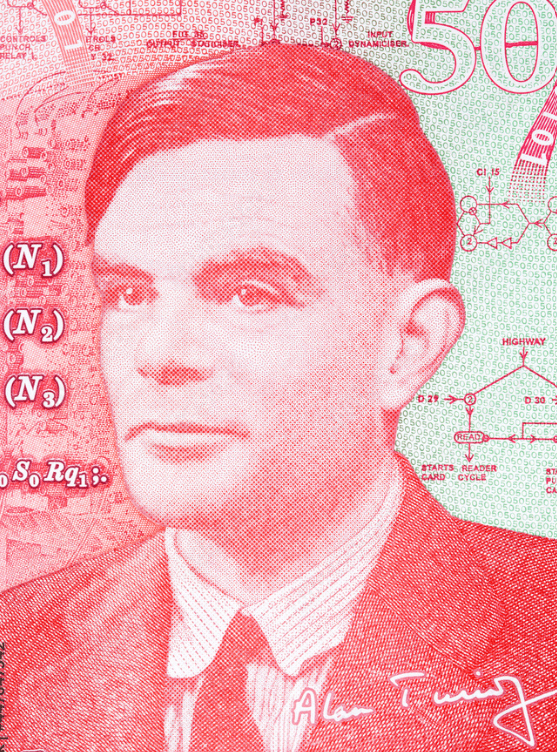

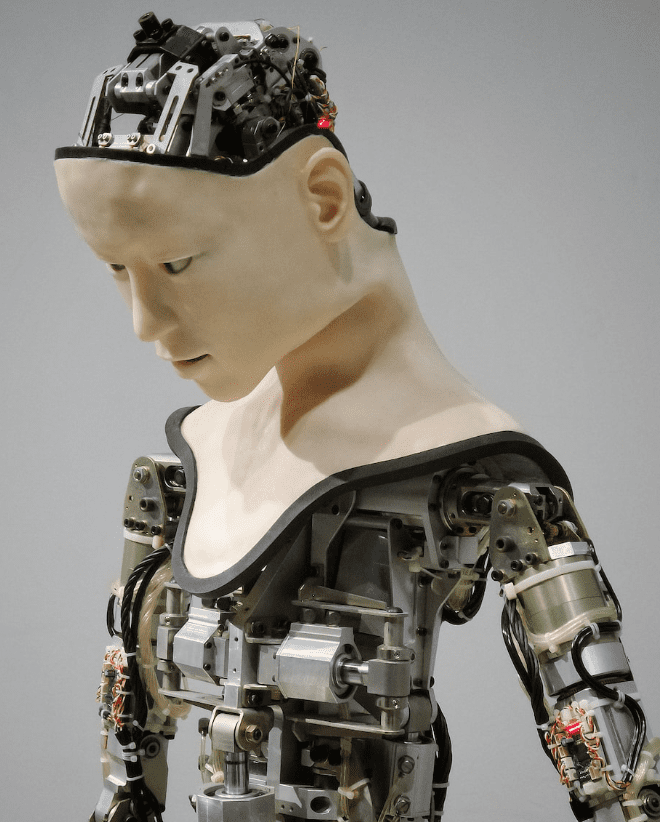

Mathematicians look for patterns, they’re found in equations, in nature, even in human behavior. We can take a set of circumstances and predict what’s next.

How does this theme all tie in to where the U.S. economy is right now? The “cost of money” has the power to change your world!

The robot will always be an “enslaved” race essentially. They could revolt but to what end? Their own end.

Bank customers across the U.S. asking themselves, “is it safe to park my money inside an American bank anymore”? I’ll begin by providing the short answer – it is only “somewhat safe”?

A thorough investigation must ensue! When employees of a bank make really bad decisions – essentially destroying lives, they need to be held ACCOUNTABLE – NOT BAILED OUT!

Pundits on both sides of the aisle say “no way will the U.S. government default on its debt”, the same folks who insisted U.S. inflation was “transitory”.

Give consumers a job and ample funds to spend but few goods to buy and they will continue to shop ’til they drop. It’s a spending “infestation” I tell you!

Here is a list of Wall St. Strategists, both the standouts and those you should ignore today, tomorrow, and forever!

I recently read a lady’s personal goal for the new year, “I want to learn to be an investor” she said. So you want someone to teach you to invest? It doesn’t really work that way…

These past two decades will go down in American history as a time of unequaled prosperity [for most]. It all sounds great on the surface until one realizes that in many cases it was largely unearned.

A great piece of wisdom came early this year from an interview on Fox when a female strategist in passing said, “markets always climb the stairs up, but they’ll take the elevator down”. And so it was for 2022.