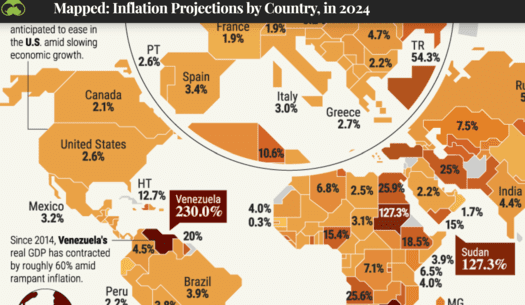

U.S. Inflation, Part II

There’s an end to every story it’s just that some must face delays for the common good.

There’s an end to every story it’s just that some must face delays for the common good.

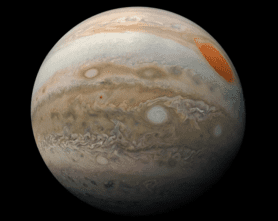

Get acquainted with the bully on the block, Jupiter… because what you don’t know CAN hurt you. 🙂

There will be those that run from you and those that run toward you. Be who you are as opposed to changing into that person you think someone else wants you to be.

Two problems I identify insure U.S. inflation will not be well behaved anytime soon. Fed policy is still too accommodative.

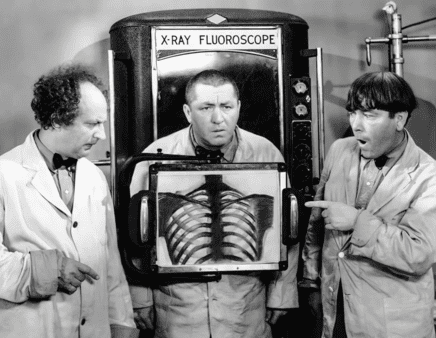

With more than 4,100 active banking charters & 4,760 credit unions, does America need 9,000 banks?

Here I uncover what many have not considered, that unique relationships exist between whole numbers. Now how can we use this information?

This from fake news and market pundits – “expect a multitude of rate cuts” in 2024. Wait, what backdrop is necessary for this to occur?

I feel as if Adam Smith was sending me a message. A guy that studied Economics at the graduate level had to witness this man who defined the virtues of Capitalism get shit on?

The Security and Exchange Commission, headed up by Leftist Gary Gensler is about to place a stamp on approval of the first “Exchange-Traded” Crypto Fund.

I sure hope our Federal Reserve gets more aggressive and “takes the medicine” by unloading their balance sheet. Let’s get the inevitable over and done with!

I can’t take someone serious when they’re sporting a nose ring. It’s 2023 A.D., not 203 A.D. so I’m trying to understand.

From the very First Bite you will know you have finally arrived… this is what being a Carnivorous Man is all about.