I Remember Back In The Day

Being all giddy at the prospects that our U.S. Government [via Congress] would actually eliminate the current progressive income tax structure, the “U.S. Tax Code” as its affectionately referred to, and implement a flat tax of 10% for everyone and every business. I loved the idea – absolutely loved it! Up until about 4-5 years ago, first COVID hit and then the double whammy – dumbasses across the United States went to the polls and voted in a Socialist Doctrine and his crime family and all his Leftist Progressive incompetents and placed them in-charge of all important agency positions. This situation has completely emptied the air out of my giddy-ness known as “flat tax euphoria”. Why? These imbeciles – the Devilcrats, have destroyed any resemblance of the United States being able to pay down its debt going forward to even approach, or get in the same ballpark as a balanced budget.

READ MY LIPS – YOUR GOVERNMENT, THE PEOPLE YOU ELECTED INTO OFFICE HAVE SPENT TOO MUCH MONEY TO EVEN BE IN THE SAME ROOM THAT ARGUES FOR A FLAT TAX. DEMOCRATS HAVE ALWAYS FAILED ON THE ECONOMY SO STOP GIVING THEM THE KEYS TO OUR TAX REVENUES! There are a multitude of reasons for this, but what it comes down to 99% of the time is that they have been irresponsible when it comes to managing our money.

A Misnomer

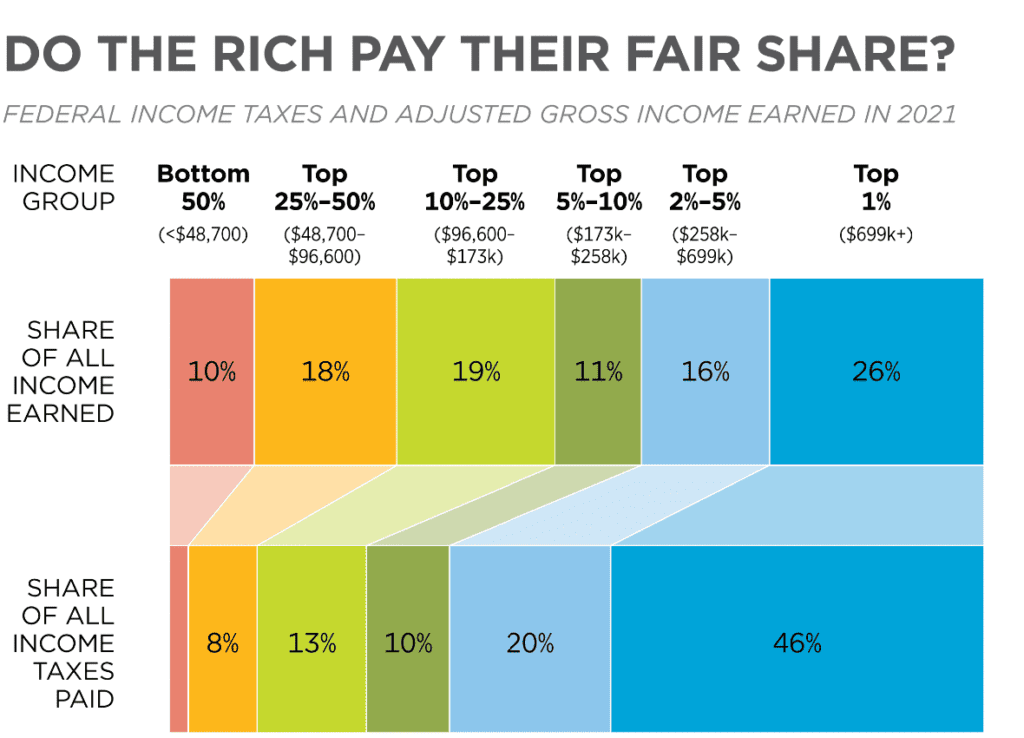

You’ve the heard the argument from the Devilcrats that “everyone should pay their fair share”. This argument from the Left [we have heard so often] is easily debunked. Wealthy citizens in our country do pay their fair share and in a host of different ways. The U.S. tax code classifies income into two main categories, or sources, ordinary income and capital gains. All of us are subject to income tax but some of us receive income that is not subject to “income tax”. For example, income produced from municipal bond holdings can be characterized as tax-free although it may be subject to Medicare tax, or even an income tax depending on what that the municipality is doing with the borrowed money? [Side note: any endeavor that can end in a profit even for a municipality can fall into “taxable income” for the recipient]. Thus, if you’re goal is to achieve tax-free income do make sure that you’re in the right bonds. Many wealthy individuals live off of the income produced from their holdings in municipal bonds, there is nothing illegal going on here, no cheating whatsoever. “Tax avoidance”, as it is referred to, is completely legal, and a great display of intelligence whereas “tax evasion” is always a crime. Please don’t confuse the two as the Devilcrats are attempting to do here.

Most Americans

Hold investments which are subject to capital gains tax, such as stocks and bonds when they are sold for a price that exceeded their acquisition cost. Long-term capital gains tax rates of 20% are considered “favorable” as this rate is lower than that of ordinary income and “short-term” capital gains. Interest income received from bank deposits and taxable bonds are subject to ordinary income taxes which are considered “unfavorable” because the rates are a progressive schedule. Ordinary income tax rates for high-income earners in the country can easily exceed those of a long-term capital gain. I personally have had years where, especially when I was working, where my ordinary income taxes and/or capital gains taxes exceeded what most Americans make in a single year so I know a little about who’s paying the most taxes in this country and the IRS Tax Tables prove this out, the more you make the larger share of it they require.

[Note: U.S. Tax Law & Taxation is one of the most difficult college courses to complete. I had to take a comprehensive course on U.S. taxes in order to sit for my C.F.P. exam more than 20 years ago, and I’m here to say this was one of the toughest subjects I ever tried to master. That coming from a guy who has completed around 200 hours of college credits. Many financial advisors who began the coursework to become Certified Financial Planners end up quitting on an attempt to successfully complete the required course in U.S. Taxation.]

U.S. Law Allows The Creation of Legal Entities

Entities such as corporations and trusts are also subject to U.S. taxation. Tax rates for these entities may differ from individual taxpayers. Corporations are still taxed at 21% [down from the previous 28%] via legislation that then President Donald Trump introduced back when he was in office. However, this tax legislation [known as the Trump Tax Cuts] will sunset in the year 2025 so Congress will need to take up the issue once again and rates will rise if the Devilcrats control Congress, as they’re have already warned. Don’t let this happen, vote Republican!

Don’t Fall For This Argument

The one claiming that wealthy people don’t pay their fair share of taxes, it’s simply a lie, not true at all. High income earners in this country pay the lion’s share of income taxes, more than 65% of all taxes collected are collected from the endeavors of wealthy people. Whereas the middle class makes up around 30% and the under-privileged make up less than 10% of total U.S. tax revenue receipts. How does this happen? The U.S. Tax Code is a progressive tax rate structure – the more your household earns the higher the rate at which you are taxed, it’s as simple as that, [see IRS tax rate tables, www.irs.gov]. Let’s step back a minute for more factual data – there are 756 billionaires and 22 million millionaires [or 8% of the population] residing in these Unites States, so that’s less than 23 million high net worth individuals in residence here and they are paying over 65% of all the tax revenue collected by the U.S. government; in a country with a total population of around 333-335 million people. Devilcrats need to stop their lying regarding who’s paying a “fair share”, this all coming from a man who between himself, his son, and his brother have taken bribes from our foreign enemies to the tune of more than $50 million dollars and yet none of it has been subject to income tax [yet]. So Devilcrats need to stop this deceit upon the American people because as it turns out Americans are paying their fair share of taxes!

A Flat Tax Notion Going Flat

Now that I have presented the background it’s time to talk about the major issue here, that of implementing a “flat tax” for the first time in the United States. This to me is the optimal solution, a tax rate where everyone’s income is taxed at the same rate. Notwithstanding the fact that some of us have more investment income [subject to capital gains] than they do W-2 income. There are two or three problems with implementing a flat tax in this country which takes away the appeal for achieving this “nirvana” in my humble opinion:

1) Here’s the obvious – let’s say a flat tax is implemented and begins @ 10%, so everyone pays a 10% flat tax on their W-2 income [ordinary income], all good except for one thing, what’s to keep 10% from becoming 15% one day and even 25% on another day? Nothing! Have you noticed one thing in this life that taxes hardly ever go down?

2) The Federal Deficit has now exceeded $35 Trillion on its way to $36 Trillion, how does that get paid down under a flat tax scenario? First of all I know how it gets paid down over time, by growing the economy [excellent leadership will be required] and receiving record tax revenue compliance over years and years and years. There is absolutely no possible way to pay down this amount of debt, an amount that is requiring the U.S. government to fund interest payments alone now exceeding $1 Trillion per year. There is absolutely no way to pay this down within our lifetimes under a flat tax rate of 10% as much as I would like to argue for it. No – it’s now too late now, the Devilcrats under the Biden Crime Family have destroyed this notion, they’ve really sealed the deal this time. Our national debt is exceeding U.S. GDP growth for the first time since the end of WWII, and you can thank the Devilcrat give-away programs for that. We’re going to not only need outsized domestic economic growth going forward and jobs, jobs, jobs, but also we’re going to need the right people in the highest offices in Washington, D.C. If you’re under the impression that these “Climate Change” Socialists are the answer to what ails the U.S. economy you need to have your head examined. No Devilcrat can possibly understand how to produce outsized growth in the largest economy in the world – that’s a fact! I’ve seen all I need to see from these idiots playing out over and over at the state and federal level and deep inside our federal agencies. The Socialists, the Devilcrats continue their long streak of being completely clueless on how to grow this economy, maintain price stability, all while protecting our borders from foreign invaders. These mandates are not possible as long as Socialists keep control of our White House… Key Reminder: Socialism has never worked anywhere!

3) Third on the list is what to do with all the CPAs and Tax Attorneys who earned advanced degrees to assist wealthy people in avoiding U.S. taxes? I have no clue here myself but under a flat tax scenario we wouldn’t need near as many of them as are practicing in the U.S. today. Maybe they can attend plumber’s school instead? After all they’re pretty good at cleaning up a personal mess. 🙂

You Still Want a Flat Tax? NO YOU DON’T!

You Still Want a Flat Tax? NO YOU DON’T!

0

0

votes

Article Rating

Subscribe

Login

0 Comments

Newest

Oldest

Most Voted

Inline Feedbacks

View all comments