Sharing an opinion here, I found it most interesting that the U.S. bond market outperformed the stock market between the years 2001 thru 2022. Mostly because when interest rates fall bond prices rise. What’s funny is that most people were never aware of it when it was happening. Like I had zero clients call me and beg me to put them into bonds all during this period of time. In fact, I had a few call me to ask that I take them out of bond exposure – that happened several times as I recall. Several times I was placed into a position where I had to defend my recommended bond exposure. Turns out that the public is so tuned into chasing stock prices that bonds can sometimes put one to sleep, I get it.

This bond outperformance phenomenon is all in the rear view mirror now as rates have been rising for quite sometime. Interest rates fell in the United States precipitously beginning in the late 1980’s, and continued to fall [mostly] well into the early 2000’s. There are lots of reasons for this, in part because during the era American manufacturing was largely offshored as we became a net importer of about everything. Simultaneously, disinflation set in and money became cheaper and cheaper to borrow. [That’s the short answer.] Then general deflation persisted in these United States for a couple three decades until one day when “woke politics” came into vogue in Washington [and some blue states] initiating a war on fossil fuels and those that produce them, along with an overwhelming desire for clean energy; and all this to combat a totally fake Democrat-born illusion known as “Climate Change”, an offshoot of “Global Warming”. Both of these were dreamed up by Leftist Democrats trying to play God. Neither one of these concepts are real, nor will they ever be real. What they are is a very costly tax on society, which is impacting both private individuals and businesses. These moves by our federal government and it’s agencies produced inflationary pressures we haven’t witnessed in this country for 40 years!

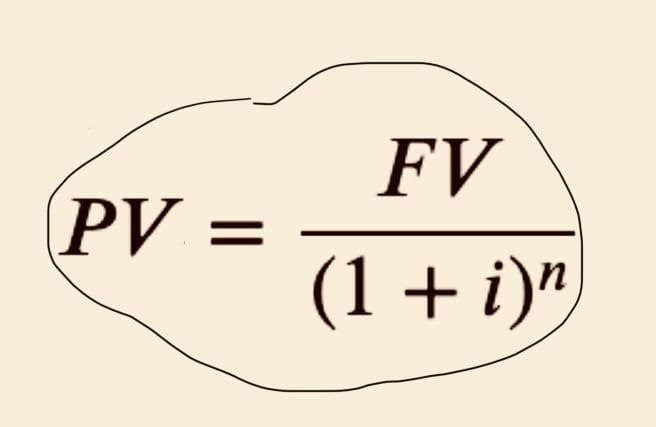

As each of you are aware the Federal Reserve has stepped in to battle this incipient inflation by raising interest rates, a major inflation-fighting tool that the Fed employs. Now we face the ramifications of increasingly higher interest rates. If you’re investing money maybe you’re not aware of how Wall St. uses interest rate levels to project the attractiveness of future corporate earnings? If you want a “take-away” from this writing then here it is – the current yield on the 10-year U.S. treasury is commonly used as a discount factor to discount future [corporate] earnings. Afterall, the U.S. stock market is nothing but a discounting mechanism [always]. When yields rise projected future earnings [growth] get compressed. Let’s take a look at examples of taking the present value of future earnings using two different discount factors:

Determining the Present Value of $100 in projected earnings five years out using a 10-year treasury yield of 3.75%:

Present Value0 = $100/(1+.0375)5

= $100/1.2021

= $83.19

Let’s say the 10-year treasury yield rises to 8.0%, look what happens to those same projected future earnings –

Present Value1 = $100/(1+.08)5

= $100/1.4693

= $68.06

The risk here is as interest rates rise in this country, the present value of future [corporate] earnings will fall. In this case from $83.19 to $68.06, or an 18% haircut! Thus, corporate earnings do not have the same appeal in a higher interest rate environments over time. Why even talk about this? Higher interest rate environments do not support high valuations in the stock market [in general]. I realize that valuation alone does not a catalyst make but still it’s a good gauge to help us understand the sustainability of a particular issue or stock index price level. Higher interest rate environments similar to what appears as if we may be entering into here can be both detrimental and beneficial depending on the choices that each investor makes. For example, there can be times in history when fixed Income, or even certificates of deposit (CD’s) can become more attractive than holding stocks, such was the case in the late 1980’s just before the stock market crash of 1987. I’m not predicting rates will climb that high in this tightening cycle, however, we are headed in that direction. Should we never come to terms with policies that fuel inflationary pressures such as the Woke Left’s war on energy plus many irresponsible Federal Spending programs, then we will surely get there… it’s only a matter of time my friend. 😉

Funny how that works,

Have you noticed that everyone [even corporations] always concentrate on the Numerators in life and never the Denominators? It undermines those things we have to deal with in dividing out every-little-thing. It’s not optimistic to talk about denominators rising, only numerators rising but denominators are still a fact of life. And they rise and fall depending on the circumstance. Lookout when denominators are rising faster than any numerator you can muster because that’s where the trouble begins. There is such a thing as “costs”, both fixed and variable not to mention things like taxes, all these act on increasing the denominator and divide the @#%$&*^! out of any numerator you can possibly imagine in this life. 😉